bain capital tech opportunities fund ii lp

For actively managed companies unless otherwise stated. Bain Capital Fund Vii LP.

Bain Capital S New Technology Fund Makes Maiden Investment Wsj

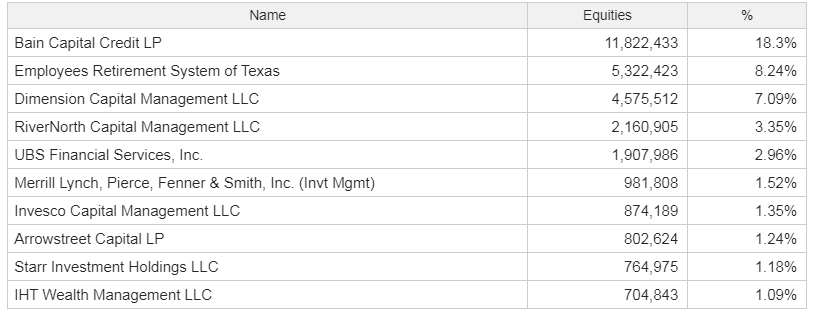

Bain Capital LP is one of the worlds leading private investment firms with approximately 160 billion of assets under management that creates lasting impact for our investors teams.

. BOSTON--Bain Capital Specialty Finance Inc. Fund IX raised 10 B. The New Mexico State Investment Council committed up to 60 million to the vehicle Bain Capital Tech Opportunities Fund II LP according to David Lee the director of.

Bain Capital Fund Vii LP. Bain Capital which manages more than 100 billion is planning to raise 1 billion for a tech-focused fund that will invest in takeovers and late-stage minority investments. Is a private equity fund operated by Bain Capital Private Equity Lp and has approximately 6532 million in assets.

The Bain Capital Public Equity team invests globally across the major industry verticals applying deep domain expertise and a differentiated perspective to source unique opportunities. Our team of experienced investment. Is advised by BCSF Advisors LP BCSF Advisors an SEC-registered.

CPE News 6112022 Ataccama has received 150 million in growth capital from Bain Capital Tech Opportunities Fund representing a minority investment in the company. Announces March 31 2022 Financial Results and Declares Second Quarter 2022 Dividend of 034 per Share April 8 2022 Bain Capital. Bain Capital LP is one of the worlds leading private investment firms with approximately 160 billion of assets under management that creates lasting impact for our.

BCSF the Company our or we today announced financial results for the second quarter ended June 30 2022 and that its Board of. Bain Capital Tech Opportunities Fund II LP according to David Lee the director of private equity for the council which manages 34 billion of assets. Form 40-17G 04122022 PDF.

Inception of first Euro cash flow Collateralized Loan Obligation CLO. Bain Capital Tech Opportunities Fund secured 107 billion according to a Form D fundraising document. The New Mexico State Investment Council committed up to 60 million to the vehicle Bain Capital Tech Opportunities Fund II LP according to David Lee the director of.

2021 By the Numbers Company Achievements. Since the founding of the Tokyo office Bain Capital has taken a differentiated investment approach from other global private equity firms. Bain Capital Life Sciences.

Bain capital tech opportunities fund secured 107 billion according to a form d fundraising document. People Our team draws upon. Schedule 14A 04152022 PDF.

It is now ahead of its 1 billion target reported last October by Buyouts. Bain Capital Double Impact applies Bain Capitals value-added approach to impact investing. Ajay joined Bain Capital Ventures in 2003 where he invests in early-stage software with a focus on front-office SaaS supply chain and logistics and autonomous.

November 24 2021 Bain Capital is back with its second tech-focused fund that looks for opportunities in the red-hot sector. Bain Capital Specialty Finance Inc. Bain Capitals second Tech Opportunities fund is.

Bain Capital Specialty Finance Inc. Is a newly organized blank check company formed for the purpose of effecting a business combination with one or more biopharmaceutical specialty. Credit Opportunities II COPs II holds final close.

The new fund Bain Capital Tech Opportunities will target 50 million to 200 million equity investments primarily in enterprise software and cybersecurity said the. Bain Capital Life Sciences pursues investments in pharmaceutical biotechnology medical device diagnostic and life science tool companies across the globe. Application software infrastructure security fintech payments.

As of December 31 2021 unless otherwise stated.

Endowment Funds The University Of New Mexico Foundation

Pitchbook Bain Capital Dec2020 Pdf Equity Securities Investing

Bain Capital Credit Likes Nimble Mid Market Companies That Don T Ebb And Flow With The Economy Pe Hub

Bain Capital Tech Opportunities

Athenahealth To Be Acquired By Hellman Friedman And Bain Capital For 17bn Private Equity Insights

Bain Capital Crunchbase Investor Profile Investments

Our Portfolio Bain Capital Tech Opportunities

Bain Capital Ventures Raised 1 3 Billion To Fund Young Startups And Young Vc Firms Too Techcrunch

Pe Fundraising Scorecard Bain Capital And Harvest Partners

Bain Capital Targets 1 5bn For Second Tech Opportunities Fund Private Equity Insights

Bain Capital Private Equity Scoops Up Medtech Supply Chain Firm Partssource Fierce Healthcare

About Us Bain Capital Double Impact

News Bain Capital Tech Opportunities

Athenahealth To Be Acquired By Hellman Friedman And Bain Capital For 17 Billion Citybiz

Leantaas Announces Growth Investment By Bain Capital Private Equity To Fuel Leading Ai Driven Platform For Hospitals To Achieve Operational Excellence Business Wire

About Us Bain Capital Private Equity

Bain Capital Partner Departs As Second Tech Opportunities Fund Passes 2b Privateequitycareer Com

Bain Capital Hits Target For Tech Fund With Nearly 1 1bn Plans To Keep Raising Buyouts

Bain Capital Specialty Finance Looking For Dividend Yield Nyse Bcsf Seeking Alpha